The PFP project will release (RED)-themed merchandise to raise funds for The Global Fund to Fight AIDS, Tuberculosis and Malaria.

ArkotNews

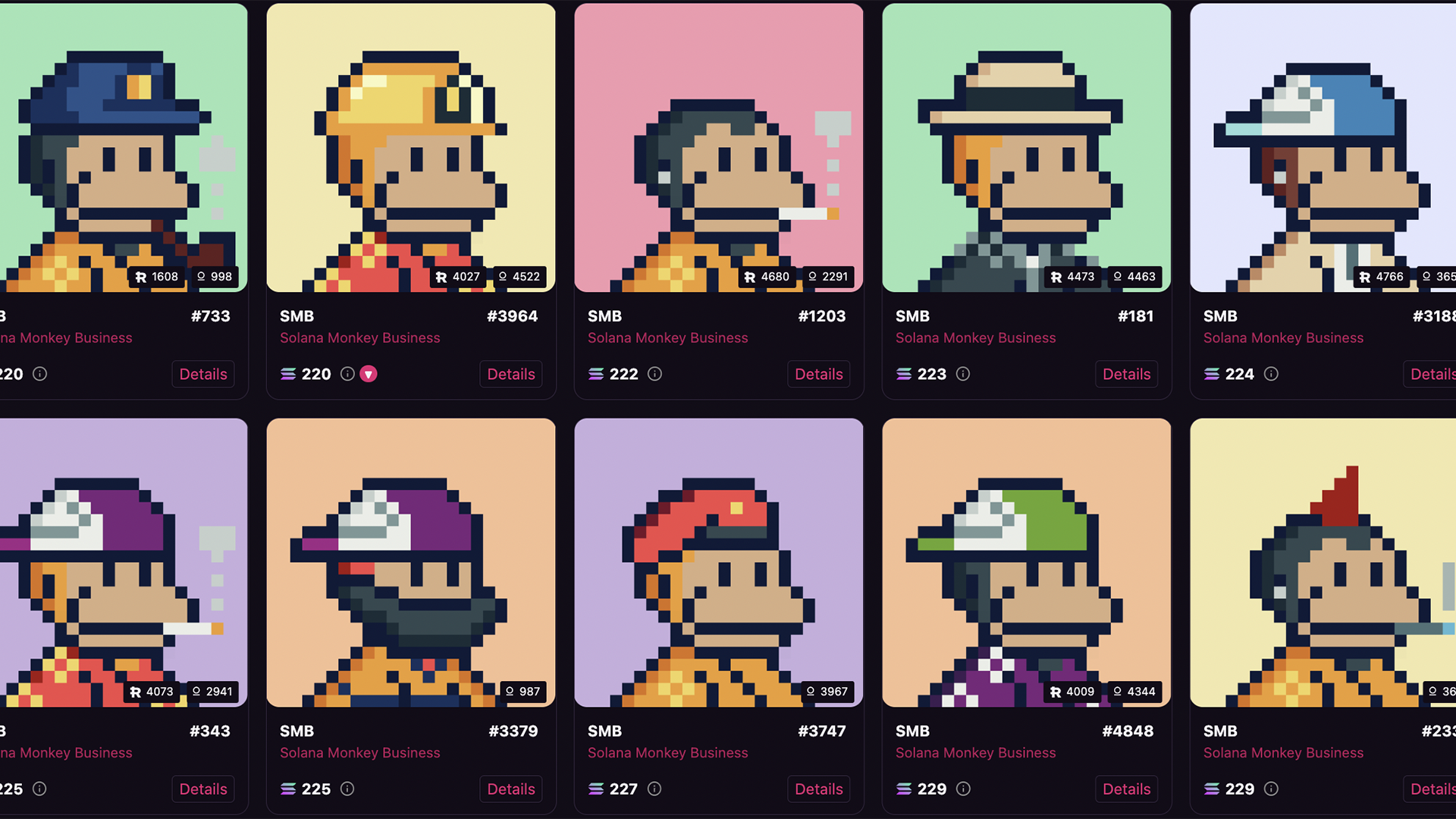

MonkeDAO Plans to Buy Rights to Popular Solana Monkey Business NFT Collection for $2M

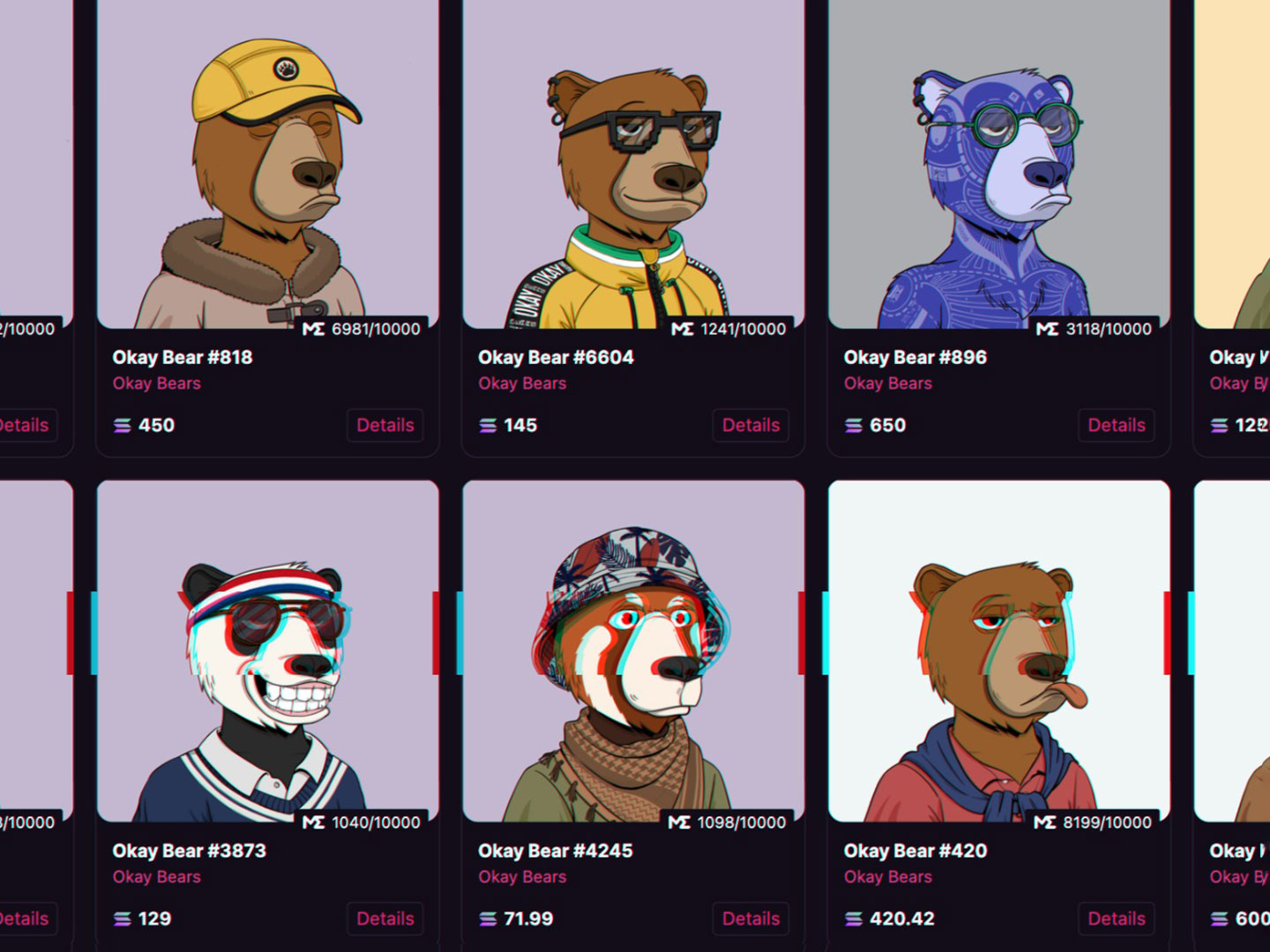

MonkeDAO, a decentralized autonomous organization formed by owners of the Solana Monkey Business NFT project, will purchase all intellectual property rights to the collection from its current owner HadesDAO.

Ether’s Post-Shanghai Rally Knocks Bitcoin Dominance From 21-Month High

ETH’s share of the total crypto market capitalization rose to a one-month high, according to TradingView data.

AI Will 'Accelerate' the Metaverse, Empower Creators: The Sandbox Co-Founder

Sebastien Borget says artificial intelligence will bring a greater volume of original content to metaverse platforms.

Former FTX US President Reportedly Quit After ‘Protracted Disagreement’ With Bankman-Fried

A new 45-page report detailing accounting failures at the failed crypto exchange says that at one point employees were instructed by an unnamed higher-up to “come up with some numbers? Idk.â€

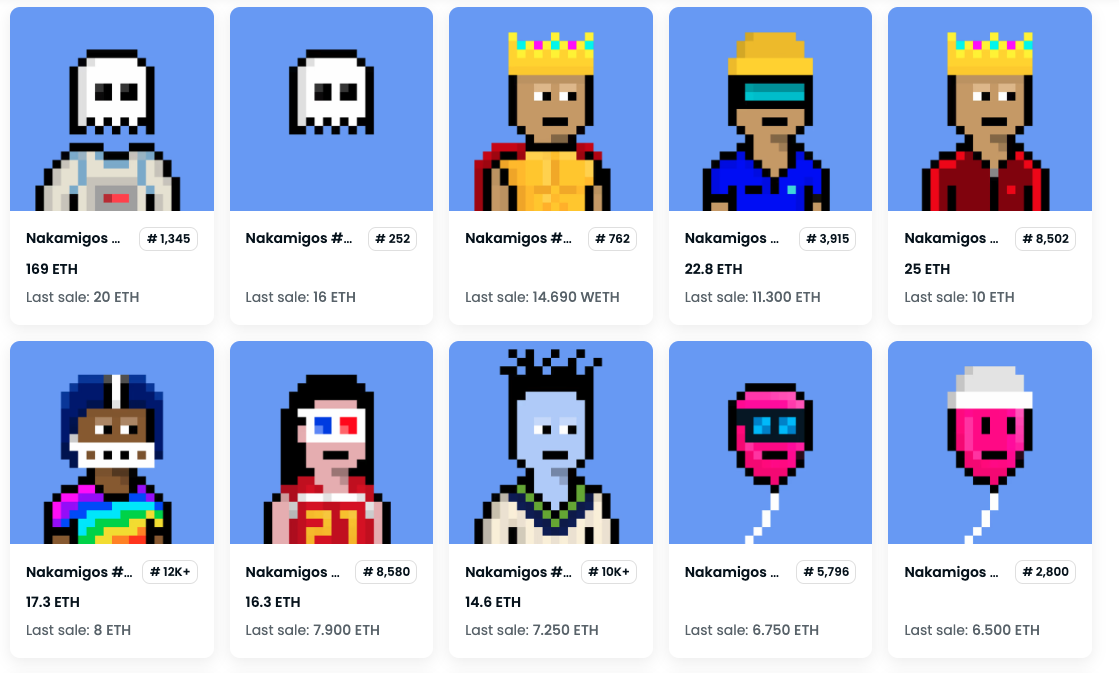

From Nakamigos to Magamigos: The Tricky Relationship Between the Meme Economy and NFTs

Speculative NFT project Nakamigos has recently broken into the NFT spotlight, spawning copycat projects such as Magamigos and Nakamigas that capitalize on the trend. But while meme projects may offer short-term gains, they rarely offer long-term value and ought be scrutinized.

ROOK Token Surges Ahead of $50M Treasury Split Between Community and MEV Tech Builders

A proposal would divvy up Rook’s nearly $50 million crypto treasury between Rook Labs, which builds MEV technology, and the new Incubator DAO.

First Mover Asia: Bitcoin Is Flat, Ether in the Red, as a Long Weekend Begins

It's a battle of bulls versus bears as the market gets a grip on reality, says Brent Xu, CEO of DeFi lender Umee. ALSO: CoinDesk columnist Daniel Kuhn writes that Elon Musk had the crypto world's attention again this week, but whether he helps DOGE is questionable at best.

Crypto-Focused Menai Financial Group Shuttering Market-Making Business in London and Tokyo

The firm said it continues to invest in and expand its asset-management business.

Hong Kong’s Financial Secretary Declares Now Is the 'Right Time' for Web3 Adoption

Finance chief Paul Chan said in a blog post that despite recent volatility in crypto, now is the time to push forward Web3 technologies.